Being a freelance translator has the wonderful benefit that you can work from pretty much anywhere in the world with customers from anywhere else in the world. But once you have to write an invoice, it can get pretty complicated pretty quickly! Do you charge your client VAT? What about the reverse charge rule? And how do you invoice for a package price?

I translate board games from English into German for clients all over the world, and I’ll tell you how I invoice my work! As I’m based in Germany, I’ll talk about how to invoice from Germany to companies in Germany, the EU or the US.

Also, quick disclaimer: I’m not a taxation specialist or lawyer, and I take no responsibility for your invoices or any errors you may find in my explanation.

What to write on an an invoice?

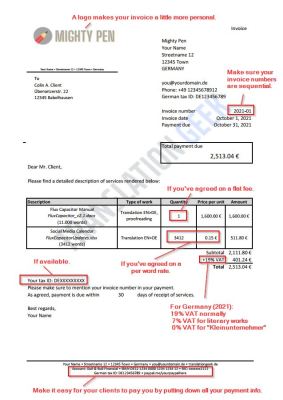

These are the things you must write on your invoice:

- Your name and address

- Your client’s name and address

- Date of invoice

- Your VAT registration number (tax ID)

- Your client’s tax ID (if available)

- Detailed list of services rendered and their price

- Sequential invoice number

- Tax rate you’re charging

These optional things should also go on your invoice:

- Your e-mail address, phone number, website URL

- Your logo, if you have one

- Payment details (so clients can pay you)

Kleinunternehmer – A regulation for small businesses

In Germany, we have the so-called Kleinunternehmerregelung (literally: regulation for small businesses), which is a way to support small businesses to make them VAT exempt.

If you’re expecting to make make less than €22,000 a year, you can apply for this and you don’t to pay the VAT (value-added tax) – or rather, you don’t have to charge it to your clients. This makes dealing with your taxes a bit easier and gives you an economic advantage, as you can offer your services for 19% less.

I wouldn’t necessarily recommend this, as it also means you can’t claim tax back on anything you buy for your freelance business – a computer, your CAT tool, web space, or whatever else you need. Besides, proper businesses won’t factor in the VAT anyway, as they will get it back from the tax office, so the advantage is minimal.

At any rate, if you do use that regulation, you mustn’t charge anyone value-added tax (VAT) for your services. (Or if you do, you have to give it to the Finanzamt, the tax office, anyway.)

Sending invoices within Germany

If you’re in Germany and you’re sending an invoice to another person in Germany, you have to charge them value-added tax (VAT) (unless you’re using the Kleinunternehmerregelung, as stated above.)

As of 2021, this tax is at 19%. How do you calculate the tax? Just divide the amount your client has to pay by 100 and multiply by 19 (or alternatively, multiply by 0.19). Example:

| Subtotal: | 2100.- EUR |

| 19% tax: (2100/100)*19 = | 399.- EUR |

| Total: | 2499.- EUR |

Even if you don’t want to spend money on fancy invoicing software, you might want to create a simple Excel sheet to fill in for every new client. (Or sign up to my newsletter to get mine.) Here’s an example of what your invoice can look like:

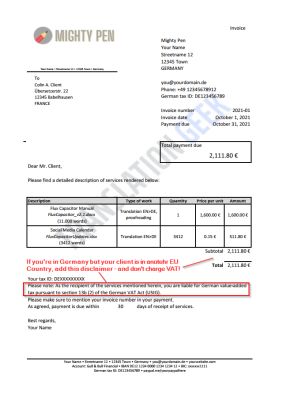

Sending invoices from one EU country to another

If you’re sending an invoice from Germany to another EU country, you don’t need to charge VAT anymore but you need to mention that they have to pay taxes on their end. This is also why you have to add their tax number to the invoice.

There are several ways of phrasing this, but the phrasing I use is from a Proz.com post from 2005:

As the recipient of the services mentioned herein, you are liable for German value-added tax pursuant to section 13b (2) of the German VAT Act (UStG).

Pro tip: If you’re working with direct clients, you’re likely sending them a contract to sign before you start work. Let the client fill in their address and tax ID when they sign the contract so you don’t have to chase them up for the details later.

Sending invoices from the EU to a non-EU country

If you’re sending an invoice from Germany to the US, to Japan, or to any other non-EU country, you don’t charge VAT anymore and you don’t need to put a note about it on your invoice either.

Side note: It might be a bit more complicated (and costly) to receive payment from these countries, but I found a free Wise account (previously Transferwise) to be a good option for receiving money from the US, if you want to give that a try.

There is also PayPal, whose fees can be very high, but they do make paying very easy. With a PayPal.me link, you can enter the amount that is due right away and nudge your clients to pay very quickly.

Here’s a sample invoice for clients from non-EU countries:

I hope this helped you in your freelance career. If you’d like to get all these invoices as editable Excel files, simply sign up to my newsletter here.

Hi, I have read your article and it helped me get things clearer since I recently moved to Germany.

I still havent charged for any project from Germany, but I would like to know if I must get a TAX ID number in Finanzamt before my first translation work, so I can be able to include this number in my invoices. I already have a Steueridentifikationsnummer, is this the one I need or is a VAT number?

Thank you very much in advance.

Hi Gaby,

I’m glad the article was helpful! 🙂

Your Steueridentifikationsnummer is different from the VAT number, which is the Umsatzsteuer-Identifikationsnummer (USt-ID). You get the USt-ID from the Finanzamt separately when you tell them you want to be a freelancer. They will make you fill in the Fragebogen zur steuerlichen Erfassung, which is nowadays done electronically via the ELSTER portal. If you speak German, this page will tell you how to go about it: https://www.fuer-gruender.de/wissen/unternehmen-fuehren/buchhaltung/fragebogen-zur-steuerlichen-erfassung/

I hope that helps!

Veronika

Thank you very much for your help! 🙂